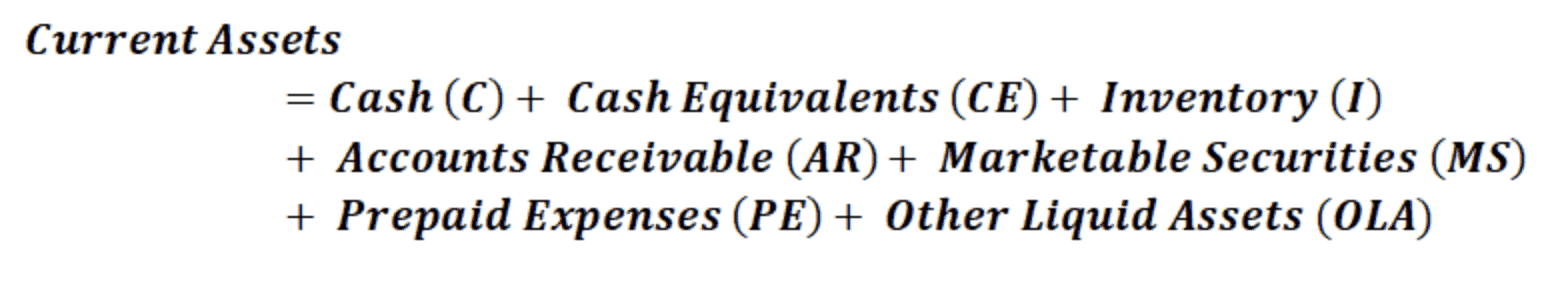

Current Assets

Current assets are resources that a company can convert into cash or extract the most value from over the next fiscal year. Cash, cash equivalents, accounts receivable, inventory, short-term investments, previously paid expenses, and marketable securities are all examples. These appear on the company’s balance sheet.

Current assets are essential for a business to finance daily business activities and day-to-day expenses because they can be easily cashed. The current assets of a company vary greatly depending on the industry and the products it sells. However, it is necessary to confirm whether the assets meet the definition of a current asset—they must be sold, consumed, and exhausted within the current year.

**Current Assets: The Building Blocks of Business Success**

In the dynamic world of business, understanding and managing your current assets is crucial for ensuring financial stability and achieving sustainable growth. Current assets, the lifeblood of any organization, represent the resources that can be converted into cash within a short period, typically one year. They play a pivotal role in meeting short-term obligations, paying bills, covering operating expenses, and fueling business operations.

**The Significance of Current Assets**

Current assets form an integral part of a company’s financial health. They provide the liquidity needed to meet day-to-day business needs, maintain inventory levels, and fulfill customer orders promptly. A robust current asset position indicates a company’s ability to meet its short-term financial obligations and maintain a healthy cash flow.

**Key Components of Current Assets**

The primary components of current assets include:

1. **Cash and Cash Equivalents:** Cash on hand, bank deposits, and short-term investments that can be readily converted into cash.

2. **Accounts Receivable:** Amounts owed to the company by customers for goods or services sold on credit.

3. **Inventory:** The stock of merchandise or raw materials held by the company for sale or production purposes.

4. **Prepaid Expenses:** Payments made in advance for services or expenses that will be incurred in the future.

5. **Marketable Securities:** Short-term investments in stocks, bonds, or other financial instruments that can be easily liquidated.

**Current Assets in Business Planning and Financial Modeling**

Current assets play a critical role in business planning and financial modeling. By understanding the composition and trends of current assets, businesses can:

1. **Assess Short-term Liquidity:** Evaluate the ability to meet short-term obligations, such as paying bills and covering operating expenses.

2. **Optimize Working Capital:** Determine the optimal level of working capital, ensuring sufficient liquidity to support business operations without tying up excessive funds.

3. **Forecast Cash Flow:** Predict future cash inflows and outflows, ensuring the company has sufficient cash to meet its financial commitments.

4. **Identify Financial Risks:** Anticipate potential financial challenges, such as bad debt from accounts receivable or fluctuations in inventory costs.

5. **Evaluate Investment Opportunities:** Make informed decisions about potential investments, considering the impact on current asset levels and liquidity.

**BznsBuilder: Your Comprehensive Financial Management Toolkit**

BznsBuilder, a business plan and financial modeling software as a service (SaaS), empowers businesses to effectively manage their current assets and make informed financial decisions. With its intuitive interface and powerful features, BznsBuilder helps you:

1. **Track Current Asset Movements:** Monitor the flow of cash, accounts receivable, inventory, and other current assets over time.

2. **Analyze Current Asset Ratios:** Assess the efficiency of current asset management using key financial ratios, such as the current ratio and quick ratio.

3. **Identify Trends and Patterns:** Uncover trends and patterns in current asset behavior to make informed decisions about inventory management, credit policies, and cash flow optimization.

4. **Create Financial Forecasts:** Develop financial forecasts that accurately project future current asset levels, cash flow needs, and working capital requirements.

5. **Evaluate Financial Performance:** Measure the impact of current asset management on overall financial performance and identify areas for improvement.

**Experience the Power of BznsBuilder**

Start your journey to financial success with BznsBuilder’s free trial. Experience the ease of use, comprehensive features, and powerful financial modeling capabilities that can transform your business management approach.

**Embrace Financial Clarity and Make Informed Decisions**

By effectively managing current assets and leveraging the power of BznsBuilder, you can gain financial clarity, make informed decisions, and position your business for sustainable growth and success.

Write your business plans twice as fast and twice as easily!

Try BznsBuilder for free.

No credit card required, no software to install.