7 Essential Qualities of Accurate and Effective Financial Forecasts

Financial forecasting is a cornerstone of success for small businesses. In fact, 90% of small business owners acknowledge its importance in maintaining a healthy operation. Yet, only 60% actually create a forecast.

What causes this disconnect?

If forecasting empowers confident decisions and accelerates growth, why isn’t it more common? The answer boils down to one challenge—complexity.

Many believe that financial forecasting requires extensive time and advanced accounting skills. However, this perception is misleading.

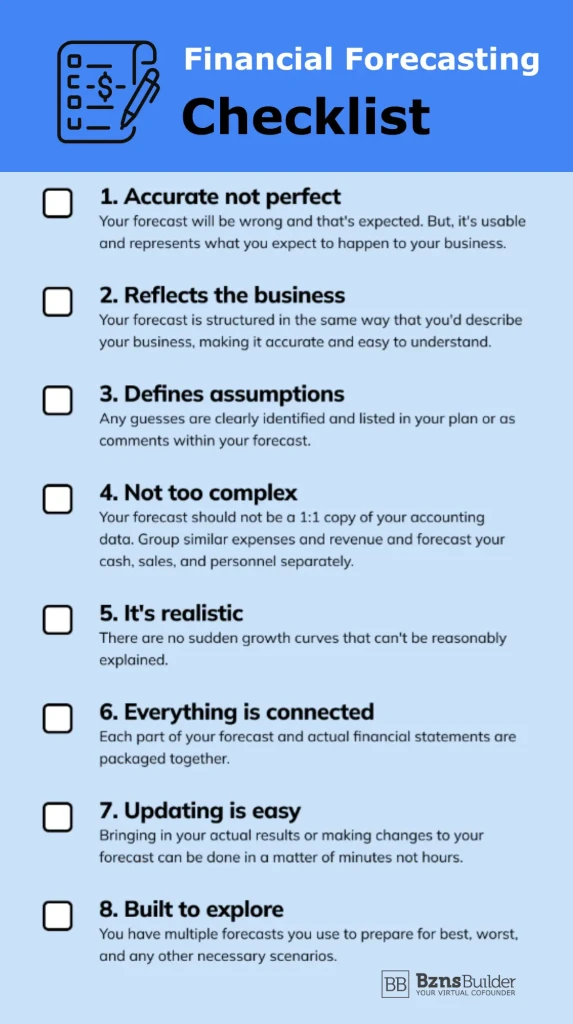

The truth is, that financial forecasting can be straightforward. By understanding the essential traits of an effective forecast, you can create one with confidence and precision. To simplify the process further, we’ve included a free visual checklist to guide you.

Key Takeaways An effective financial forecast is:

-

Realistic

-

Up-to-date

-

Detailed but practical

-

Relevant to your business

1. Embrace Imperfection

Financial forecasting isn’t about achieving perfection. Predicting the future with absolute accuracy is impossible, and that’s okay.

The real value of forecasting lies in its ability to highlight deviations—known as “misses” or “variances”—between your predictions and actual performance. These variances are powerful indicators of where your business is excelling or falling short. They reveal opportunities to adjust your strategies and maintain steady growth.

If perfectionism is holding you back, think about this: avoiding forecasting doesn’t prevent surprises—it just leaves you unprepared to understand or address them. Adopting a growth-oriented mindset by regularly forecasting, reviewing, and refining your projections will enhance your decision-making over time.

Perfection is not the goal. As BznsBuilder CEO Riham Abu Elinin puts it, “A financial forecast isn’t about flawless predictions; it’s a practical tool to represent your business realistically and guide smarter decisions for sustainable growth.”

2. Specific but Simple

Your financial forecasts don’t need to match your accounting statements exactly. Striving for a one-to-one alignment only adds unnecessary complexity.

Forecasts are designed for you—not your accountant. They should have enough detail to reflect your business operations without becoming overly complicated. Simplifying your forecasts makes them easier to review, update, and use as a decision-making tool.

Here’s how you can simplify your forecasts:

-

Group similar revenue streams, such as all pastries for a coffee shop, and related expenses, like utilities.

-

Forecast personnel, revenue, and cash flow separately.

-

Start with expense forecasts and categorize them into COGS, fixed, and variable costs as needed.

Balancing granularity and simplicity is key. Avoid overwhelming yourself with excessive data, but ensure you capture the critical information necessary to guide your decisions. Remember, you can always add more detail later as your business needs evolve.

3. Sets Realistic Expectations

A good forecast isn’t overly optimistic or based on wishful thinking. It’s a realistic representation of where your business is headed, grounded in solid data and reasonable assumptions.

Think of your forecast as a snapshot of your business’s future. It reflects the goals you aim to achieve based on current decisions, market conditions, and anticipated customer behaviors. Your projections should align with your business plan, financial history, and internal targets. If they don’t, you might need to reassess your strategy.

Practical forecasting means avoiding unrealistic projections, like sudden “hockey stick” growth curves without justification. It also involves accounting for unexpected expenses and maintaining sufficient cash reserves to navigate uncertainties.

If this sounds daunting, remember the first principle: you don’t need perfection. You just need a forecast backed by thoughtful reasoning. As you revisit and refine your projections over time, they’ll evolve into a more accurate and actionable representation of your business’s direction.

4. Accurately Reflects Your Business

As BznsBuilder CEO Riham Abu Elinin often highlights, “Accuracy in forecasting isn’t about being perfect; it’s about being current.” For a forecast to be truly accurate, it needs to stay up-to-date.

This means regularly updating your forecasts with real sales, expenses, and cash flow data as it comes in. By doing so, you’ll ensure your projections remain relevant and useful for guiding decisions. Neglecting updates, on the other hand, can cause your forecast to drift away from reality, potentially leading to misguided choices and missed opportunities.

Keeping your forecast accurate and reflective of your business’s current state is essential for making informed, strategic decisions that support growth and resilience.

5. Works with Your Larger Financial Plan

While your financial forecast is distinct from your financial statements (such as the balance sheet, income statement, and cash flow statement), the two should work hand in hand.

To effectively review performance and refine your forecasts, you need to examine them alongside your financial statements. This allows you to compare expectations with actual outcomes and dig into specific line items to uncover actionable insights.

For example, if your actual sales are lower than forecasted, reviewing your profit and loss statement can help identify which products or services underperformed. Similarly, if expenses are higher than expected, your cash flow statement can reveal where adjustments might be needed.

Think of your forecast as providing a high-level roadmap, while your financial statements offer detailed insights. Together, they create a comprehensive picture of your business, enabling you to identify trends, address challenges, and capitalize on opportunities effectively.

6. Easy to Update

Financial forecasting should enhance your business, not hinder it. When done right, it streamlines your financial review process, supports informed decision-making, and helps you plan effectively for the future.

To gain these benefits, your forecasts must evolve with your business. Regular updates—at least monthly—are essential to integrate real-world data like sales, expenses, and cash flow. If your forecasts are overly detailed or complicated, sticking to this update schedule becomes challenging and turns forecasting into a frustrating process.

This is why it’s crucial to choose a forecasting platform that simplifies updates. While spreadsheets or basic tools might work initially, they can become cumbersome as your business grows. Dedicated financial forecasting software, like BznsBuilder, integrates with accounting data, automates updates, and includes built-in reporting features to save time and ensure consistency.

Investing in a user-friendly platform makes it easier to maintain accurate forecasts, leading to better financial planning and decision-making.

7. Provides Room to Explore

While you can’t predict the future, you can prepare for various possibilities. A good financial forecast allows you to explore potential scenarios and plan accordingly.

Scenario analysis enables you to evaluate how different internal decisions or external factors could impact your business. For example:

-

What happens if you expand your business?

-

How would leasing versus buying a property affect your outcomes?

To perform scenario analysis, you need the ability to duplicate and adjust your forecast for specific situations. This flexibility highlights the importance of keeping your forecast simple, realistic, and easy to update. If it’s overly complex, managing multiple scenarios becomes time-consuming and impractical.

By starting with a well-structured forecast that meets these criteria, you unlock the ability to explore countless possibilities and make strategic decisions to drive your business forward.

Start Forecasting Today

Entrepreneurs often see financial forecasting as a daunting challenge, something they know is important but feel unprepared to tackle. By understanding the characteristics of a good forecast, these fears can be eased.

If you’re ready to take the next step, explore BznsBuilder’s intuitive forecasting tools. Our platform simplifies the process, offering AI-powered recommendations, automated updates, and user-friendly reporting features. Say goodbye to spreadsheets and complex formulas and hello to a guided forecasting experience you can complete at your own pace.

Get started today and empower your business with forecasts that drive confident decisions and sustainable growth.