Business Forecasting: Creating Your First Financial Forecast Without Historical Data

Creating a financial forecast without historical data may seem intimidating at first, but it doesn’t have to be overwhelming. As a new business owner, you may be starting from scratch and thinking:

- Where do I even begin?

- How do I ensure the numbers are accurate?

- Do I even have enough time to create a forecast?

Here’s the good news: Forecasting doesn’t need to be complex, perfect, or time-consuming. With the right approach and tools, like those provided by BznsBuilder, you can create a solid working forecast without any historical data in as little as two hours.

Who is this guide for?

This guide is perfect for entrepreneurs who are just starting out, have no real-world financial data to rely on, and are concerned about keeping their numbers on track.

A few tips before you start forecasting…

- Don’t aim for perfection: Your forecast won’t be perfect, and that’s perfectly fine. As our CEO, Riham Abu Elinin, often says, “A good forecast should reflect your business reality, not predict the future.”

- Set a time limit: The key to successful forecasting is staying focused. Set a time limit of 30-45 minutes and see how far you can go. This will keep you from getting bogged down in the details.

- Break up the work: You may need more than 30 minutes to complete your forecast. Plan 3-4 short sessions and step away in between. Taking breaks will make it easier to return to your forecast with fresh insights.

- Seek feedback: Even if your forecast is a work in progress, ask a trusted colleague or mentor to review it and provide feedback as you go along. The more input you get, the stronger your forecast will be.

- Think of your business story: Forecasting is not just about numbers. It’s about creating a narrative for how your business will grow and thrive. BznsBuilder helps you transform those numbers into a clear and actionable business plan.

- Experiment with the numbers: Financial forecasting is about exploration and iteration. Don’t be afraid to play with your numbers. With BznsBuilder’s intuitive tools, you can easily adjust and test different scenarios without worrying about making mistakes.

By following these tips and using BznsBuilder’s powerful tools, you’ll be well on your way to creating a realistic financial forecast, even without historical data.

Session 1: Ideas and Educated Guesses

Goal: Get comfortable making educated guesses and create your first draft of revenue and expense forecasts.

1- Figure out how you will make money and what you will pay for

Before you start crunching numbers, it’s important to identify your revenue and expense categories. These will be the individual line items you’ll forecast later on.

Don’t overcomplicate this step. Spend just a few minutes listing potential revenue streams and expenses. If you’re unsure where to begin, tools like BznsBuilder can help generate ideas and guide you through the process.

In the end, you should aim for 3-6 revenue categories and 3-6 expense categories.

If you have more than six, consider grouping similar revenues and expenses together. Keeping the number smaller makes it easier to manage and adjust your forecast as needed.

Example

Let’s say you plan to sell mobile accessories in various colors—blue, red, green, and metallic magenta. Instead of listing each color individually in your revenue forecast, you would group them into one category called “mobile accessories.”

The same approach applies to your expenses. If you have costs like electricity, insurance, and a water bill, you can group them under a category like “utilities.”

2. Make Your Best Guesses

Now that your forecast categories are set, it’s time to add your numbers.

To make the process more manageable, avoid tackling all your revenue and expense categories at once. Instead:

- Start with either revenue or expenses.

- Pick one category and add your numbers.

- Move on to the next category.

Only after completing one side of the forecast—either all the revenue or all the expense categories—should you move on to the other side. Remember, these are educated guesses for each month. They don’t need to be perfect and will likely change as you refine your forecast.

Should you start with revenue or expense forecasts?

I recommend starting with revenue, as it tends to be more exciting. After all, it’s how you will generate income for your business. The anticipation of seeing your business grow financially can provide the momentum you need to complete your forecast.

However, some experts, including BznsBuilder’s advisory team, suggest beginning with expenses. They argue, “It can be easier to figure out what you need to spend each month,” which can give you a clearer picture of your overall cash flow.

Ultimately, there’s no right or wrong choice—just start with whichever part feels most comfortable for you. You’ll need to forecast both sides anyway, so don’t get stuck on the decision.

Guessing for Revenue (Sales)

Think of forecasting revenue as setting goals for your business.

You should avoid making the mistake of starting with the size of the entire market and claiming you will capture a certain percentage of it. As our experts at BznsBuilder often point out, “This kind of guessing might look plausible, but it’s not based on actionable data and real market conditions.”

Starting with a large market size—like predicting you’ll reach 40,000 people within 10 miles of your business—can lead to unrealistic expectations. Instead, start by evaluating your own capabilities and actions as a business owner and work your way up from there.

Here are some questions to help guide your process:

- How many potential customers can you reach out to?

- How many will respond or visit?

- How many of those will end up purchasing from you?

- What is the average amount they will spend?

Example:

Let’s say you are opening a new café in New Cairo. Based on foot traffic and marketing outreach, you predict that within one month:

- 10,000 people will learn about your café.

- 8% (800) will visit the store.

- Of those who visit, 70% (560) will make a purchase.

- On average, each customer will spend 100 EGP.

Guessing for Expenses

For your expense forecast, list how much and when you expect to pay for each category. Here are a few tips to get started:

- Don’t overcomplicate the types of expenses yet: At this stage, you don’t need to classify expenses under fixed, variable, or COGS (Cost of Goods Sold). Keep it simple for now.

- Include your salary: Even if you don’t plan to pay yourself immediately, note down when and how much you expect to earn eventually.

- Forecast personnel costs separately: If you plan on hiring employees, include their salaries under a category such as “personnel” or “payroll.”

3. Repeat the Process

After you’ve made your first set of guesses for either revenue or expenses, repeat the process for the category you haven’t worked on yet.

If you’ve been working on your forecast for more than 30-45 minutes, it’s a good idea to step away and return for another session. Taking breaks will help you maintain a fresh perspective and ensure that you don’t get bogged down by the details.

Session 2: Make the Numbers Fit Your Business

Goal: Adjust your revenues and expenses to align with the “story of your business.”

In this session, come with an open mind and a willingness to experiment with your numbers. Remember, you’re not finalizing your forecast yet—you’re simply checking if your initial guesses match your expectations.

To help get into the right mindset, try explaining your business to someone. Imagine talking about it to a friend, family member, or potential investor. How would you describe it?

If you’re unsure where to start, try answering the following questions:

- What are your plans for this month, next month, and this year?

- What outcomes are you expecting? Are these expectations realistic?

- Do your current numbers reflect this vision?

Repeat this process for each month. If your current numbers don’t align with your expectations, consider adjusting individual revenue streams or expenses. By the end, your numbers will start resembling a working forecast that aligns better with your business goals.

Tips for Telling Your Business Story with Your Forecast

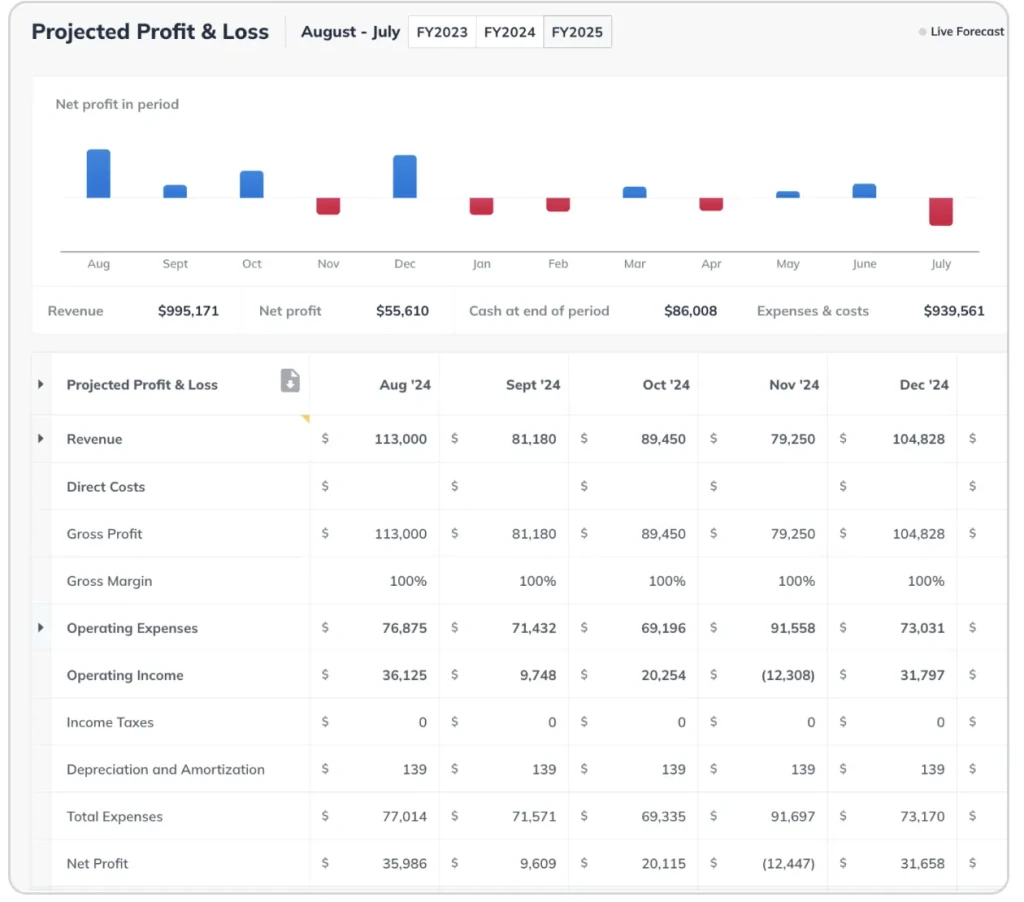

- Connect to a graph or chart: Instead of drowning in numbers, visualize the impact of your adjustments with a graph. If you’re using BznsBuilder, you can easily adjust your forecasts directly on the graph, making it easier to track changes visually.

- Watch out for unrealistic performance: If your expenses seem too low or your sales growth appears overly optimistic (such as the typical “hockey stick” growth), take a moment to revisit the numbers and ensure they’re grounded in reality.

- Focus on profits: It’s perfectly fine for your expenses to exceed sales at the beginning, but you want to see a gradual improvement over time. This demonstrates that your business model is sustainable and on track for profitability.

Session 3: Get Specific

Goal: Make your revenue and expense forecasts fit standard financial statements.

You’re almost there! Now it’s time to organize your revenue and expense categories into the appropriate types so the numbers fit into your financial statements. After this step, you can make any final adjustments.

If you’re using BznsBuilder to create your forecasts, your financial statements will automatically be generated as you input your data—no extra work required on your part!

Revenue Considerations

When forecasting revenue, here are the three key questions you should ask:

- Are materials and labor directly used to produce your product?

If yes, you need to account for direct costs, known as the Cost of Goods Sold (COGS). If your business is service-based, you can likely skip this step.Isolating these costs from other expenses helps you understand how efficient your business is. If you’re spending too much to produce your product, leaving little room for other expenses, you’ll struggle to achieve profitability.

Tip: If possible, make COGS a percentage of each specific revenue stream. That way, when you adjust revenue, your COGS will automatically adjust as well.

- Will customers make recurring purchases?

This is important if you offer a subscription-based product or service. In that case, customers will be automatically charged either monthly, quarterly, or annually.You’ll need to account for recurring revenue as well as the possibility of customers “churning” or canceling their subscriptions.

Tip: Don’t stress about accurately predicting churn just yet. Pick a percentage of customers you expect to lose each month, and adjust as real results come in. Use resources like Stripe’s churn rate guide to help estimate this.

- Will you see seasonal changes?

Many businesses experience fluctuations in sales based on the time of year. For example, Halloween stores often see dramatic upswing in August through October, followed by a sharp decline. While your seasonality may not be as obvious, it’s still important to consider potential sales spikes or declines throughout the year.Tip: As your business grows, it’ll become easier to predict seasonal demand. In the meantime, you can use Google Trends to see if interest in your industry or product shifts during different seasons.

Expense Considerations

Aside from separating COGS, you’ll need to categorize your expenses as follows:

- Fixed Costs: These are expenses that remain consistent, such as rent and insurance.

- Variable Costs: These change month-to-month, like marketing or utility expenses.

- Personnel Costs: Whether fixed or variable, separating these will help you track staffing needs and the return on each employee.

- Assets: Large purchases, like vehicles or machinery, should be classified as assets. While they still represent spending, they are not technically expenses. These will show up on your balance sheet and cash flow statement but not on your profit and loss statement.

Tip: Don’t overcomplicate your expense types. If you’re unsure, you can always adjust or leave some expenses unclassified for now.

Session 4: Understand Your Cash (and Funding) Needs

Goal: Determine whether you have enough cash to cover expenses.

It’s time to dive into your cash flow. When you review your current forecast, you might see negative cash flow. This isn’t necessarily a bad thing—and in fact, I encourage you to expect this at this stage.

At this point in your business journey, you might not know exactly how much cash you need to start and run your business. That’s why you’re creating a forecast in the first place.

Now, use this session to determine how much cash you need and where it will come from.

1. Drop in Your Starting Cash

This is the money you plan to invest in your business. It could come from your savings, a bank loan, an initial investment from friends or family, or a combination of these sources.

If you’re not using any personal cash or haven’t secured a loan yet, don’t add any starting cash to your forecast.

2. Review Your Cash Position and Runway

Now, look ahead and start asking yourself some important questions:

- Is this starting cash enough to cover expenses until you generate revenue?

- How much cash are you burning through each month?

- Even if you start generating revenue, will you run out of cash? If so, when?

The goal here is to determine if you have enough cash to cover your expenses until you reach a point where your business is cash flow positive (when your incoming cash exceeds your expenses). If not, it’s a sign that you need additional funds to extend your runway.

3. Figure Out What It Will Take to Avoid Being “Cash Negative”

Think of financing as your “cash band-aid.” It helps fill the gap in your cash flow until your business can generate enough revenue.

The simplest way to figure out your funding needs is to add up all your expenses until you achieve cash flow positivity. Then, include a cash “buffer” to account for unforeseen delays or expenses.

4. Decide If Additional Funding Is Necessary

Look at the number you calculated and ask yourself, “Am I comfortable taking on this amount of debt?”

If the answer is no, revisit your revenue and expense forecasts. Look for ways to start with less additional cash. If the answer is yes, explore your funding options and think about the loan terms or other funding details you’re comfortable with.

Bonus: If you’re feeling ambitious, duplicate your current forecast and create an alternative financial scenario where you secure the necessary funding. How do your financials look now? If the funding is a loan, how will you manage repayment?

You’re Already Better at Financial Forecasting

Based on a recent survey of small business owners, businesses that create financial forecasts are more confident in their direction. However, over 42% of business owners still don’t have a working budget or forecast.

By taking the first step and creating your initial financial forecast, you’re setting yourself up to make informed, confident decisions for your business.

Remember, no one knows your business better than you do. You’re the best person to carry out this work. The more you predict, review, and adjust your forecasts, the easier financial forecasting will become.

You can also use a financial forecasting tool, like BznsBuilder, to simplify the process of building, reporting, and updating your forecast. With BznsBuilder, you can connect to accounting software, explore different financial scenarios, and even receive an AI-powered performance analysis every month.

If you’re not quite ready to invest in a tool but still want to learn more about forecasting for your business, check out these resources:

- Manage your business better with a living forecast: Learn how to keep your forecasts alive with regular plan vs. actual analysis.

- Tips for more accurate cash flow forecasts: Use these five tips to improve your cash flow projections.

- Inform your forecasts with industry benchmarks: Discover how to leverage industry data to start your forecasts and see if your estimates are on the right track.